BRANDING YOUR BUSINESS

November 15, 2023

INTRODUCTION TO DIGITAL MARKETING

November 16, 2023Finance is the ability to manage money, focusing on how money is managed and what is the actual process of acquiring needed funds.

A Roadmap is a documented guide/direction while Financial Management is the financial roadmap for your finances or financial activities, which involves Planning, Organizing, Directing and Controlling of your financial activities.

WHY FINANCIAL MANAGEMENT OR ROADMAP?

Financial Management or Roadmap enables you to:

- Get Organized – By taking a look at your total assets, any liabilities and your spending habits.

- Set Goals – What do you want to accomplish this year and in the long term?

- Evaluate your budget – Review your budget regularly as expenses may change and you may be able to find expenses you can cut.

- Build savings – Establish a saving plan for an emergency fund, short and long term savings, retirement etc.

- Pay off debts – Think about actionable strategies on how you can at least minimize debts.

PERSONAL FINANCE involves understanding WHY money is important and HOW managing your money can help prevent future financial difficulties.

Paramount in once’s life is making FINANCIAL DECISIONS and this is associated with it’s own risk.

Money flows in 2 directions :

i. Into your ownership

ii. Out of your reach

Personal Finance includes: Budgeting, Insurance, Savings, Investing, Debt servicing, Mortgages and more.

WHAT IS YOUR ATTITUDE TO MONEY?

Your Personal attitude, Life stages, Culture, Life events, External Influences, Interest rates affects your attitude to money.

How would you rate your own attitude to money? Do you take risks? Can you think of a time when your attitude to money was irresponsible?

How could you have behaved differently? What factors influence your attitude to risk?

| FINANCIAL PLANNING PROCESS | ||||

| STEPS | COURSES OF ACTION | |||

| Step 1 | Determine your current financial situation | |||

| Step 2 | Develop your financial goals: | |||

| What is my Need? | ||||

| What is the money cost required? | ||||

| When do I need this to materialize? | ||||

| What is the number of days/weeks/months involved to save? | ||||

| Do I save per day/week/monthly? | ||||

| Step 3 | Identify alternative courses of action | |||

| Step 4 | Evaluate the alternatives | |||

| Step 5 | Create and Implement a financial action plan | |||

| Step 6 | Re-evaluate and Revise the plan | |||

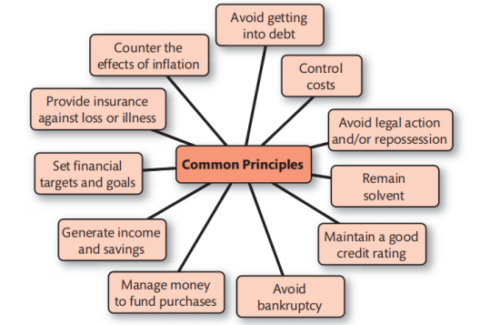

COMMON PRINCIPLES IN PLANNING PERSONAL FINANCE

BUSINESS FINANCE

Business Finance is divided into 3 Core areas:

- Corporate Finance: These focuses on decisions relating to how much and what types of assets to acquire. How to raise capital needed to purchase the asset identified.

- Capital Markets: Interest rates, prices of stocks and bonds are determined. The Financial Institutions are involved with regulatory agencies.

iii. Investment: These looks at decisions around stocks, bonds, the pricing and how much to invest.

BUDGETING AND FORECASTING

WHY BUDGET?

Budget is an operational plan and a control tool for an entity that identifies the resources and commitments needed to satisfy the entity’s goals over a period. The quantitative expression of a proposed plan of action by management for a specified period. Budgeting is an essential part of the continuous planning for an organization in order to accomplish long-term goals. In simple terms, it is a forecast of future events.

PLANS:

Operational planning: concerned with short term day to day planning process.

Budgetary planning: is mainly concerned with preparing the short to medium term plan.

Strategic planning: concerned with preparing long term action plans to attain the organization’s objectives by considering the changes at horizon.

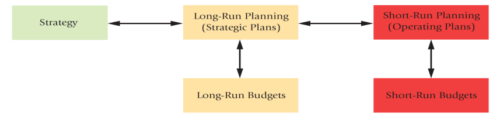

STRATEGY, PLANNING AND BUDGETS

The above shows that strategic plans are expressed through long-run budgets, and operating plans are expressed through short-run budgets. It also shows arrows pointing backward as well as forward. The backward arrows show that budgets can lead to changes in plans and strategies.

FORECASTING

A vital function of managing any business is planning for the future. Experienced judgment, intuition and awareness of economic conditions may give business leaders a rough idea of what may happen in the future. This experience may be supported by various quantitative methods that can be used to forecast such outcome as next quarter sales volume. In addition degree of uncertainty needs to be incorporated in to the decision making process.

What is Forecasting?

Forecasting is a tool used for predicting future demand based on past demand information. Demand for products and services is usually uncertain.

Forecasting can be used for:

- Strategic planning (long range planning)

- Finance and accounting (budgets and cost controls)

- Marketing (future sales, new products)

- Production and operations

BUILDING A SAVINGS CULTURE

Saving – placing money in a secure place so that it grows in value and can be used in the future.

This can be done via Individual savings account (bank) and for a higher interest rate, use Nassara Necessary savings, Save with Nassara.

₦2,000 and ₦10,000 weekly savings contribution to build a disciplined savings culture and meet your goals.

INVESTMENT

Investment – speculative commitment to a business venture in the hope that it generates a financial reward in the future.

In investing one’s scarce resources a SINGULAR DECISION can make or mar your lifetime journey and experiences.

Evaluating most of us, our human capital is gradually declining while it is expected that our financial capital (all asset) should be on the increase.

Our investment horizon appetite determines where we put our money. Your Relationship Network = Your NETWORTH

Investment Outlets:

Bonds (Government and Corporate), Treasury bills, Commercial papers, Shares (Nassara Shares is available), Nassara Bulk Investment etc

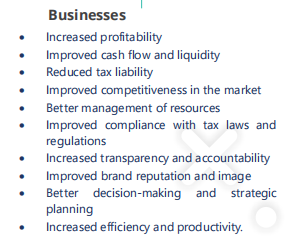

TAXES: EFFECTIVE TAX MANAGEMENT

Tax deductibles expenses leads to tax savings and there are reforms on-going to promote tax equity. You will do well to yourself and business, if you pay your taxes on time and avoid the huge penal charges and embarrassment to your image.

MANAGING DEBTS/CREDIT MANAGEMENT

Do well, to pay up your debts it makes you financially responsible.

You must draw up a reasonable plan to save from your income regularly and pay back what you owe within a specified time frame. A good name is better than gold.

My Final thoughts:

The more knowledge you have, the more opportunities are open unto you – Seek Knowledge, Seek to know. Knowledge breeds inspiration.

Plans are not as valuable as the paper on which they are written on, if not implemented – Execute your plans.

Nothing is rarely as good as you think, just as there’s nothing as bad as you can imagine – Launch out.

Finally, according to Abrahim Lincoln, the best way to predict the future is to create it.

Nassara Ladies, it is time to start creating that future, your future.

AYOADE ADEOSUN ACA